Value Edge

Value Edge (VE) is an adaptive entry and exit target price model service. It is designed to be profitable without filtering or conditional logic applied. VE uses a collection of proprietary analytics to identify optimal target prices for both random and

cyclic value in multiple market environments and classifications.

VE can be applied individually or combined with any type of strategic concept(s) at the trader's discretion. It's purpose is

to offer more precise targets to improve outcome consistency and overall profitability. Value Edge will be available

for a select group of stocks, futures, ETF's, FX and Bitcoin.

This service will be launched by Sept 1. Join our newsletter list for prompt notification.

cyclic value in multiple market environments and classifications.

VE can be applied individually or combined with any type of strategic concept(s) at the trader's discretion. It's purpose is

to offer more precise targets to improve outcome consistency and overall profitability. Value Edge will be available

for a select group of stocks, futures, ETF's, FX and Bitcoin.

This service will be launched by Sept 1. Join our newsletter list for prompt notification.

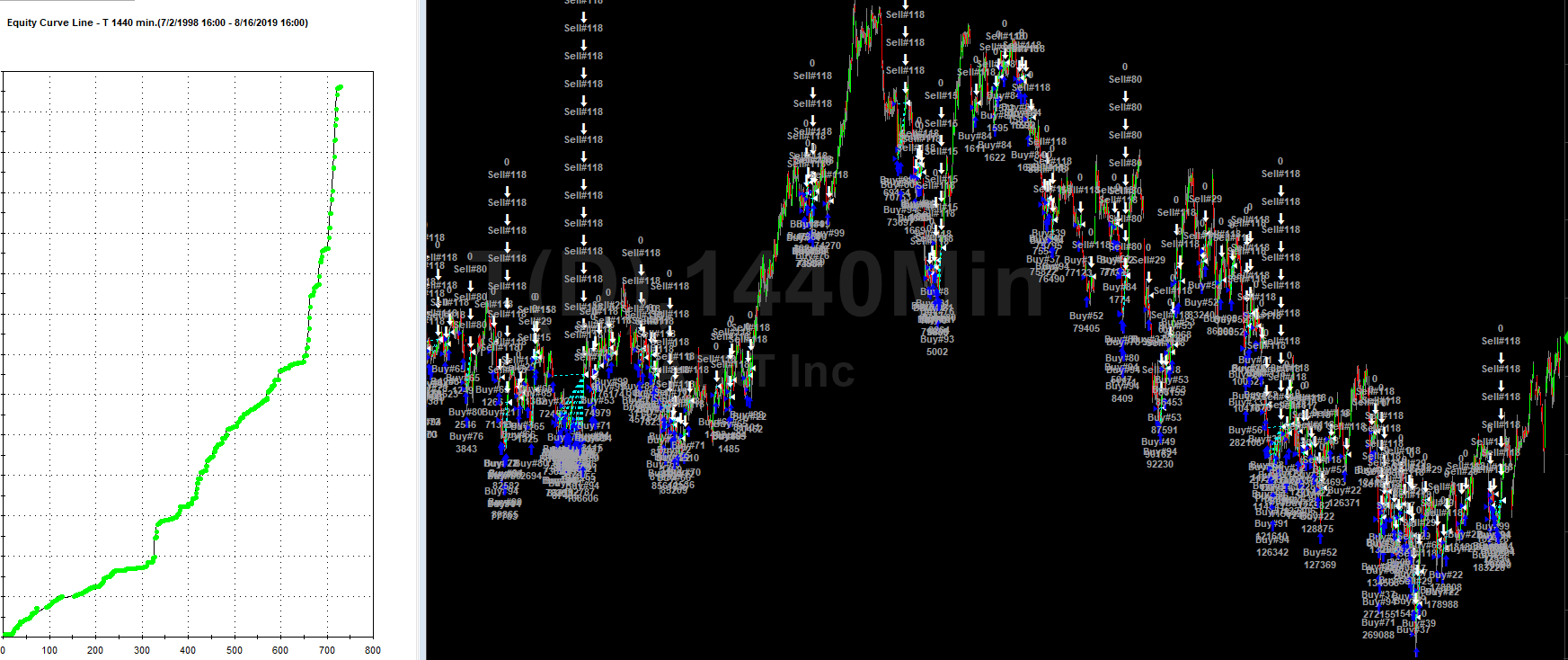

The examples below are simulations of Value Edge applied to AT&T as a strategy. Chart on left is single entry set shares.

Chart on the right employs multiple entry and compounding money management. These are for illustrative purposes only.

Chart on the right employs multiple entry and compounding money management. These are for illustrative purposes only.

Check out the examples below of the daily reports for subscribers to the Value Edge service.